By Louise Atkinson, primary school teacher and President of the National Education Union

In September, the National Education Union launched our campaign for Free School Meals for All, urging the Government to extend hot, healthy school dinners to every child in primary school in England.

Since then, educators, doctors, dentists, parents, youth workers, faith leaders, councillors and more have banded together around this demand. All of us are united by the belief that no child in Britain should go hungry and every child should have the basics to learn and thrive.

Why Free School Meals for All

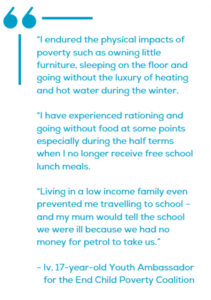

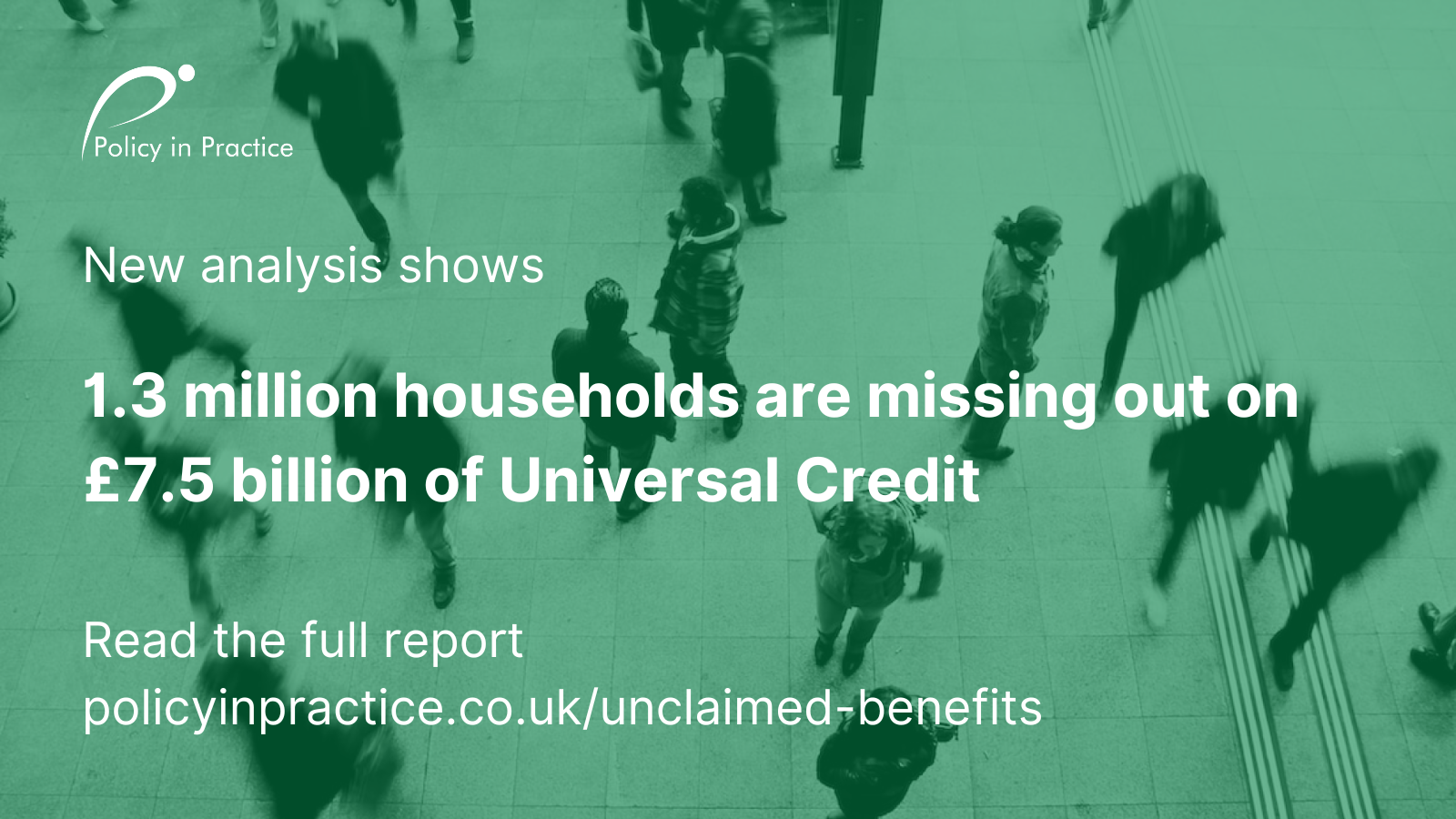

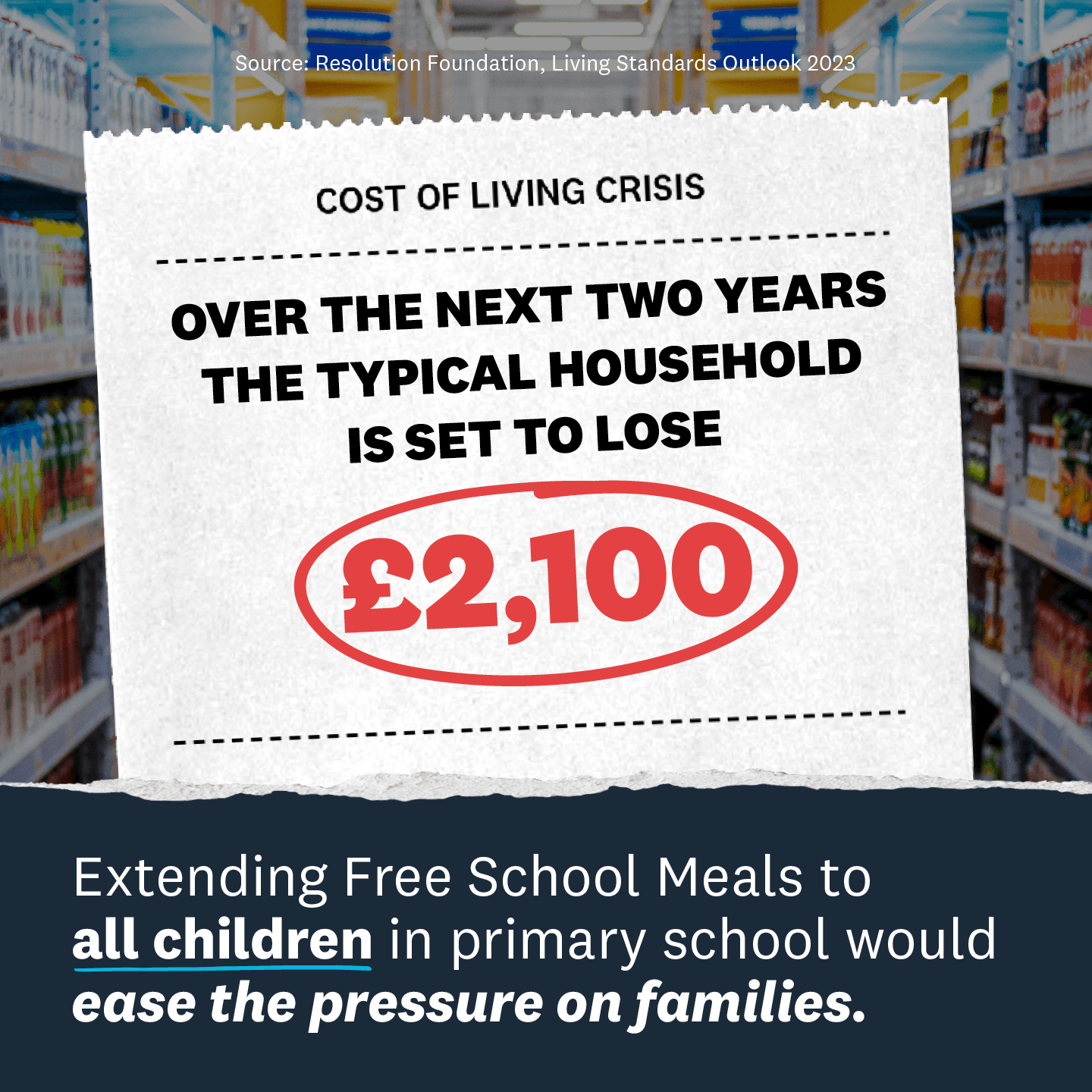

Last year, four million children experienced food insecurity — not having access to nutritious and balanced meals, or some having to skip meals entirely.

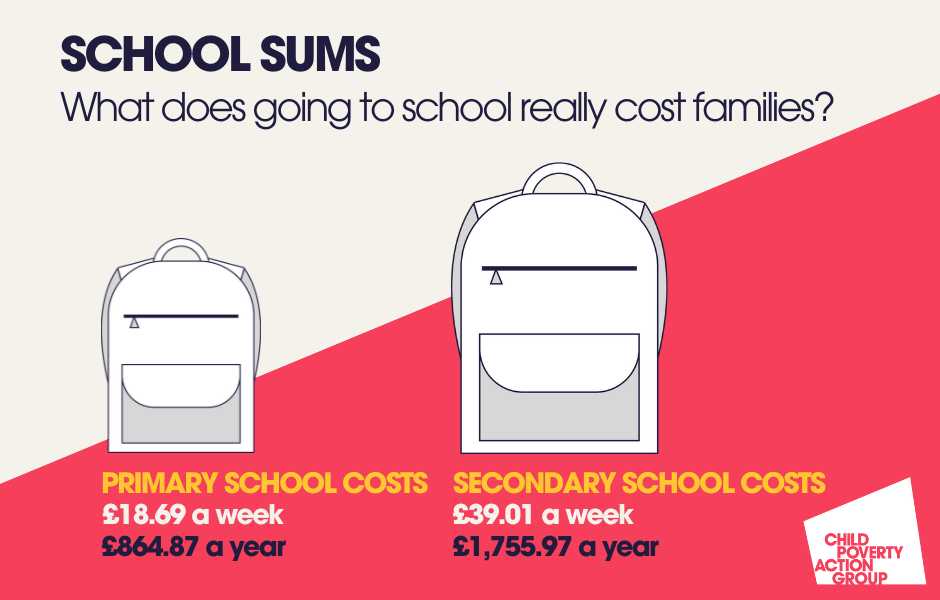

As teachers, we know food is part and parcel of a good education. Free School Meals boost academic attainment, they help children focus in class and connect with their peers.

But restrictive eligibility guidelines, low thresholds and bureaucracy block too many families from this support.

Providing Free School Meals for every child is the only way to ensure no child goes short of food at school. It increases healthy eating for every pupil, and ensures children can eat and socialise together, free from stigma or shame.

We already do this for our very youngest children. For the first three years of school, every child in England gets a hot school dinner – and no child under seven wants for food while they’re at school. But from year three on, the Government stops Free School Meals for All.

How we can win this for every child

The power of this campaign is in the broad and committed coalition behind it. Together, we’ve moved the needle further in eight months than any of us could have done alone.

200+ civil society leaders have signed a joint open letter to the Prime Minister calling for Free School Meals for All. From Greater Manchester Poverty Action to Feeding Liverpool, from the British Medical Association to Fans Supporting Foodbanks, from Mayor Andy Burnham to the Trades Union Congress.

In partnership with MP Zarah Sultana, we introduced the Free School Meals for All Bill in Parliament – more than 70 MPs from seven parties have declared their support so far. Next, Mayor Sadiq Khan announced an emergency scheme extending Free School Meals to every child in a London primary school for one year.

And we’re only getting started.

Add your voice to this campaign

Next month, we will hold a Week of Action for Free School Meals for All to spotlight the issue and turn up the heat to pass the Bill. This mobilisation will culminate in the hand-in of our open letter to Downing Street on 29 June.

If your organisation or group supports extending Free School Meals to every child in primary school, sign our joint open letter and we’ll take your message straight to the Prime Minister.

When you sign, you’ll join a dedicated, diverse coalition pushing for a better future for children. You’ll be included in regular updates and invited to briefings, and we’ll share the different ways you can be involved in the campaign.

Together, we believe we can win Free School Meals for All.

Read about the campaign on our website, sign the open letter for your organisation/school/council using this form, or email campaigns@nochildleftbehind.uk if you have questions or would like to learn more.