New report from the Samaritans

By Adele Owen QPM, Greater Manchester Suicide Prevention & Bereavement Support Programme Manager, NHS Greater Manchester Integrated Care

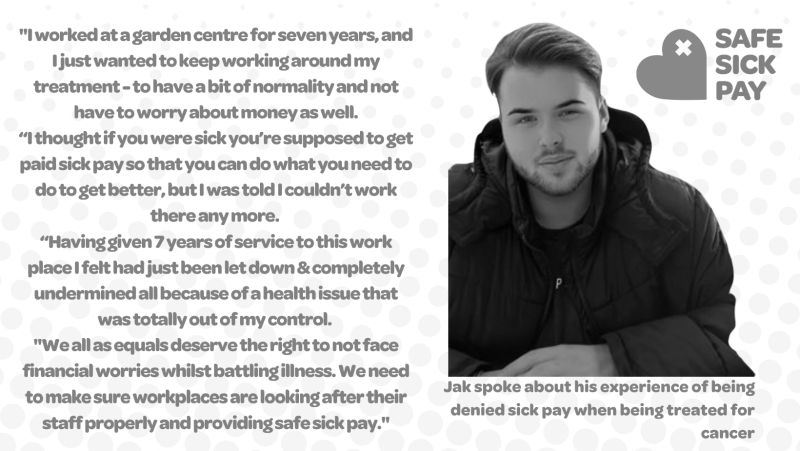

With our partners in the Suicide Prevention Consortium, we have been exploring the relationship between economic disadvantage, suicide risk and self-harm in people’s own words.

We heard about experiences of economic disadvantage and how they relate to suicide, self-harm and bereavement by suicide. People told us about what they have found helpful, including a sense of community belonging, as well as changes they would like to see. Together with people with lived experience we developed recommendations that focus on creating a more human and person-centred whole system approach. We also need a system that is more aware of mental health issues and the economic challenges people face.

Three key changes we would like to see:

Better understanding in health services of self-harm and suicide risk: People expressed that neither their attitudes and beliefs, nor the complexities around suicide and self-harm were consistently taken into consideration as part of their care within the health system.

Suicide and self-harm awareness training within social security systems: People shared that their experiences of engaging with the benefits system were particularly difficult when they were in distress. There is an urgent need for increased understanding of self-harm and suicide by social security providers and for them to take an approach that is based on believing people’s experiences of distress.

Comprehensive funding and resources are needed for community based support: People shared the importance of inclusive support within their local areas, but expressed a lack of availability of appropriate support for them. They also highlighted the role of meaningful relationships as key protective factors for staying well and the need to increase opportunities to develop these.

Read more in our report: Insights from experience: economic disadvantage, suicide and self-harm.

“The conversations were raw, but they were real, from the heart, and you heard in the voices of the people telling us their lived experience that poverty, economical disadvantages were a catalyst in creating a tipping point to harming oneself or attempting to end it all. The people in the conversations had survived, (for now) but the truth is that the conversations need to continue, this work must become a new catalyst, one for change or at least one to help make change happen. My life has had ups and downs like many, but truly when you are not only dealing with your own mental health, or dealing with a worldwide pandemic too, the red line which is the need for change is also the issue of not being able to be warm or eat. Continue the conversation as there is a lot more to say.”