We want your views

By Lucy Bird, Fundraising Officer

Click here to complete the Greater Manchester Poverty Action Annual Impact Survey 2022. Deadline is Wednesday August 17th, 2022.

We run our annual survey to find out more about how the people in our network perceive our work, what they value and the different ways in which GMPA has an impact. The findings will help inform our work and support us when making a case to funders and other stakeholders.

The survey should take around five minutes to complete and not every question is mandatory. We really value how our network engages with and supports us and would greatly appreciate you taking the time to complete the survey. The more responses we receive, the better it can shape our work.

Through providing us with your views, you are helping us get closer to achieving our shared vision of a Greater Manchester free from poverty.

Click here to complete the survey.

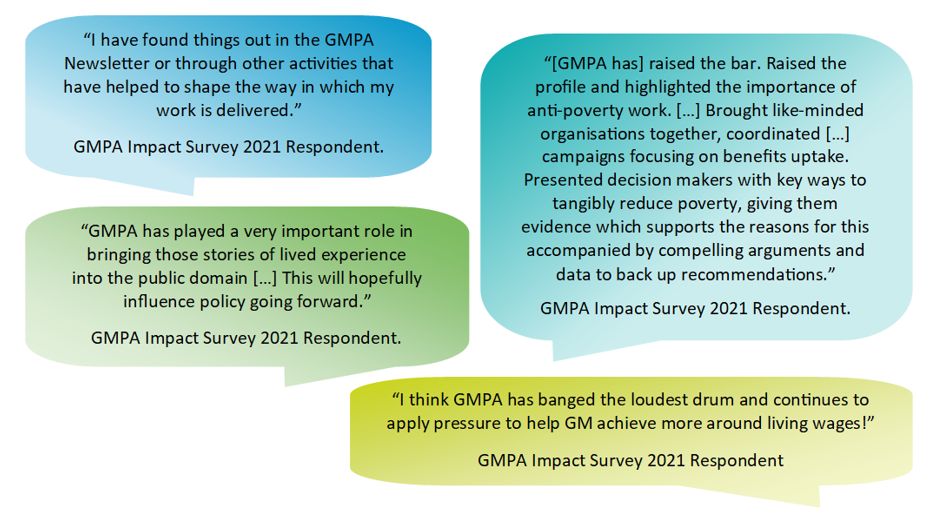

You can view the results of GMPA’s 2021 Annual Impact Survey and read more about our impact here.

Deadline for completing the survey is Wednesday August 17th, 2022.

GMPA’s network is made up of over 1700 stakeholders from across Greater Manchester’s voluntary, community and social enterprise (VCSE), public and private sectors. It also includes some members of the public and national organisations involved in tackling poverty.

Our vision is of a Greater Manchester free from poverty where all residents can realise their potential and access the benefits of living in a diverse and vibrant city region