Debt

Debt

Debt plays a crucial role in determining the nature of poverty and the experience of people on low incomes. Debt can compound poverty and eat into already limited resources.

On this page you can find out more about debt levels in Greater Manchester, using data provided by the city region’s Citizens Advice branches. Debt is an issue across the city region, with many people who are in-work, including people in fulltime employment, experiencing debt problems. Energy bills are a common cause of debt among Citizens Advice customers.

Please note we are awaiting some additional commentary from Citizens Advice to aid interpretation of the data illustrated on this page.

Want the latest poverty information, data, stories and news delivered straight to your inbox? Sign up to our fortnightly newsletter.

Amount of debt

This chart shows the average amount of debt of those seeking debt advice, by local authority, in the last four years. The most recently available data (2021) shows that people seeking debt advice in Manchester were on average in excess of £3000. In the other nine Greater Manchester boroughs, the average level of debt among those seeking advice was between £1000 and £2000.

Since 2017, the average level of debt among those seeking advice has varied across the boroughs and the difference in average debt levels between Manchester and the nine other boroughs was less pronounced in the years prior to 2021.

Employment and debt

In work poverty is a major problem in the UK, including in Greater Manchester. Avoiding debt is difficult for many people in low paid work.

This chart shows the work status of people in employment who have sought debt advice from Greater Manchester branches of Citizens’ Advice. Across all of Greater Manchester’s borough a higher proportion of people working full or near to full-time hours (i.e. 30 hours or more) have sought debt advice compared to those working less than 16 hours, those working between 16 and 29 hours and those classed as self-employed.

Debt advice and payday loans

This chart shows the proportion of people seeking debt advice from Greater Manchester branches of Citizens’ Advice who have reported previously taken out payday loans. Payday loans are relatively small loans that need to be repaid over a short time period. They often charge high interest rates and high penalties are applied if repayment conditions aren’t met. For these reasons, payday loans can compound debt and result in significant financial hardship.

Whilst the proportion of people saying they have taken out a payday loan previously appears low in each borough, there have been changes over time. In Bury, for example, the proportion of people seeking debt advice who said they had taken out a payday loan was 8.8% in 2019 but only 2.6% in 2021.

People seeking debt advice

This chart shows the profile seeking debt advice from Citizens’ Advice branches in Greater Manchester by age, disability, ethnicity and gender.

The majority (59.6%) of people seeking debt advice in 2021 were aged 25 to 49. A majority also fell into this age category in 2017, 2018, 2019 and 2020. Young people (aged under 25) have made up a growing proportion of those seeking debt advice over recent years (up from 0.97% of cases to 5.72% of cases in 2021).

Whilst a majority of people seeking debt advice from Citizens’ Advice in Greater Manchester are categorised as ‘not disabled’, a significant proportion are experiencing long-term health problems (38.1% in 2021).

In terms of ethnicity, a majority of those seeking debt advice are categorised as ‘white’. This has been true in each year from 2017 to 2021. In respect of gender, a majority of those seeking debt advice were female in each year over the same period.

Debt enforcement

This chart shows the proportion of people who have sought debt advice from Citizens’ Advice branches in Greater Manchester who have been subject to a debt enforcement.

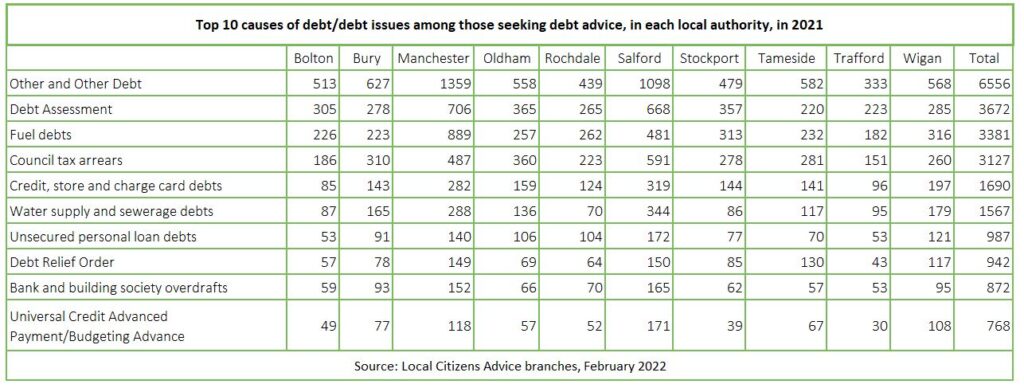

Causes of debt

This table shows causes of debt recorded by Citizens Advice branches in Greater Manchester in 2021 across the city region’s ten boroughs. Causes of debt vary, with council tax arrears and fuel debts being a common problem. We are awaiting further analysis from Citizens Advice so that we can provide greater insight into these figures.

Please click here to return to the GM Poverty Monitor 2022 main page and the list of sub pages

Poverty Monitor 2022: Debt